With Argentex, businesses and financial institutions benefit from competitive rates, effective risk management and market leading technology. Client funds are safeguarded with Tier 1 banks to ensure that your money is in safe and capable hands.

1

The only UK listed business that is an E-money and investment institution regulated to hold client money

5,500+

Trusted by over 5,000 corporate and institutional clients since 2012

LN:AGFX

Argentex Group PLC is listed on the London Stock Exchange

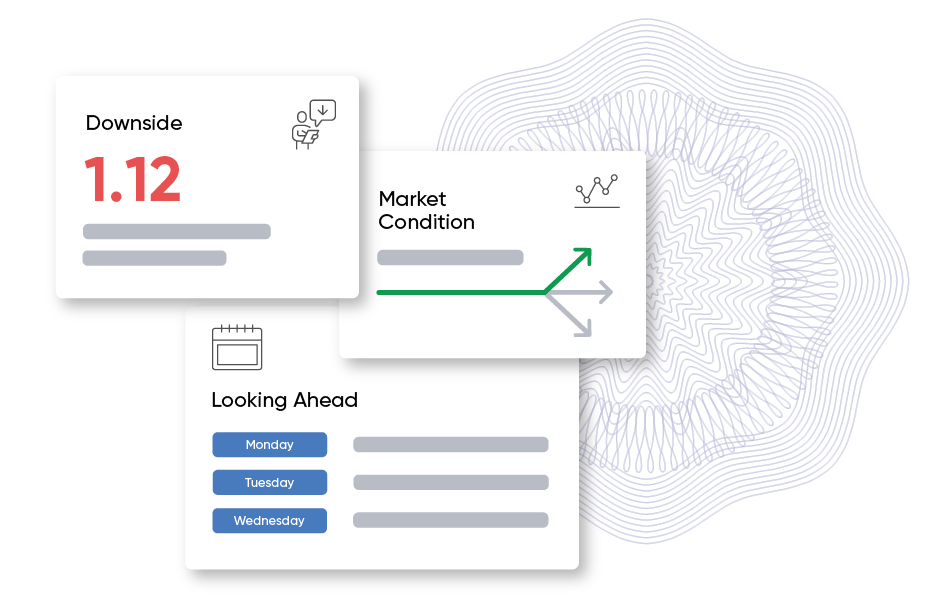

Your dedicated risk manager will develop effective strategies and hedging solutions that meet your unique requirements.

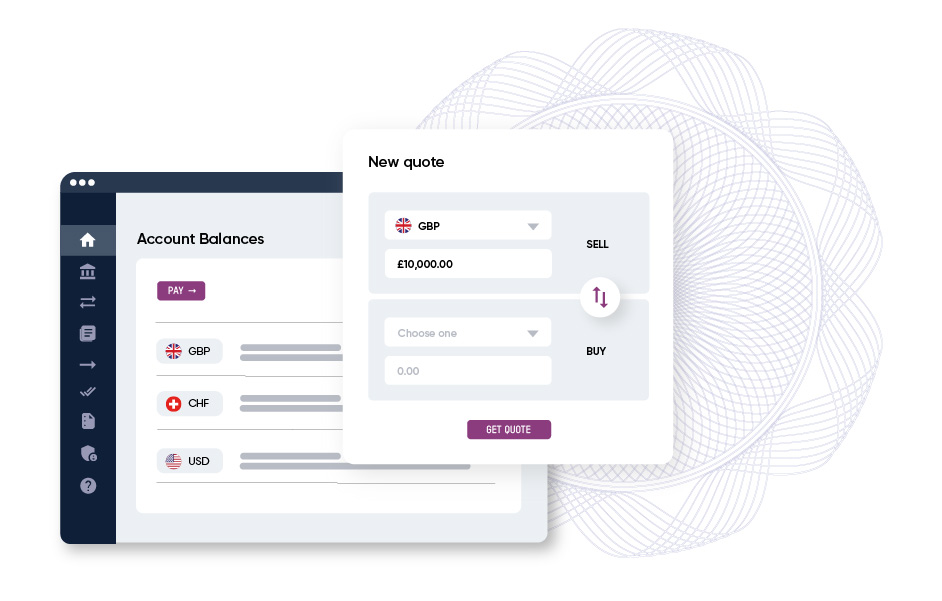

With quick and easy onboarding, your multi-currency account can hold and receive funds whilst supporting payments in 140 currencies.

Download your copy of the FX Navigator, which analyses the macro themes affecting FX markets and price direction for sterling, the euro and US dollar for 2024.

This in-depth report covers:

Operate with ease, speed and convenience. Argentex blends a high level of service with customisable, intuitive technology.

Receive concise technical and fundamental analysis along with a schedule of key data releases for the week ahead. Delivered to your inbox every Monday.

Get in touch and speak with one of our experts to streamline your global payments and currency risk management strategies.

Argentex Group PLC

25 Argyll Street

London, W1F 7TU

United Kingdom