150+

Employees globally

30+

Authorised to trade in over 30 countries

2012

Trading since 2012

Argentex is a global expert in currency risk management and alternative banking for businesses and financial institutions. Argentex is listed on the London Stock Exchange, with offices in the UK, the Netherlands, Australia and the UAE. We’ve transacted more than $200bn for our clients since 2012, making payments in up to 140 currencies on their behalf.

Argentex is a debt-free, cash-rich business and operates as a Riskless Principal broker for non-speculative commercial currency transactions.

On 25 June 2019 the company listed on the London Stock Exchange AIM (LN:AGFX).

The pedigree of asset managers, pension funds, investment banks and family offices that have since invested in Argentex is testament to our robust business model and experienced leadership team.

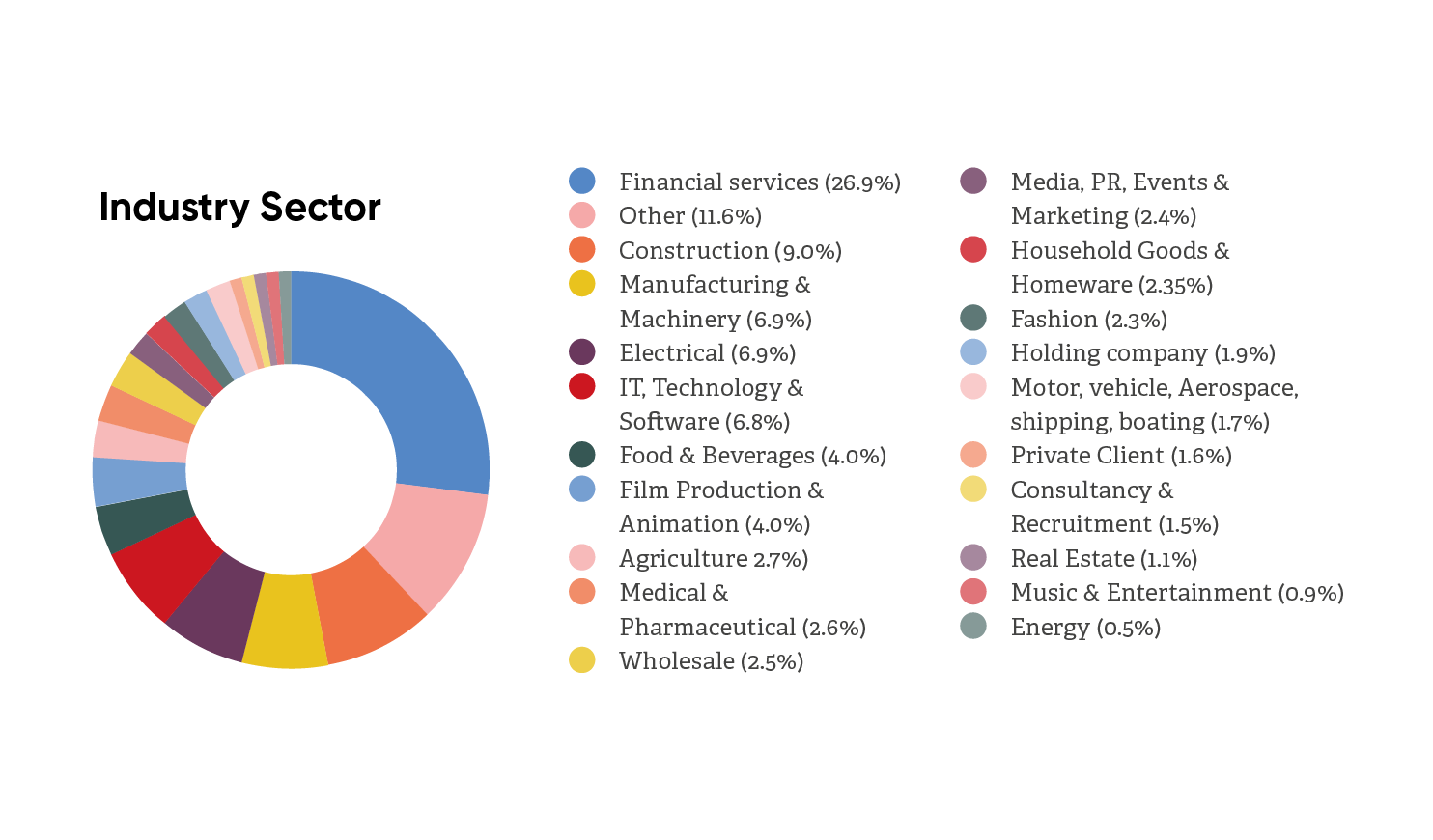

Our diverse global client base comprises of businesses and financial institutions across many industries, each choosing Argentex to help them effectively navigate their currency risk exposure and access wholesale rates.

Download a copy and find out more in our latest Annual Report for the year ended 31 December 2024.

Meet our experienced, driven and passionate leadership team with a proven track record in delivering growth for all stakeholders.

Head Office

Argentex Group PLC

25 Argyll Street

London, W1F 7TU

United Kingdom

Industries

Solutions