Published date: 14 July 2025

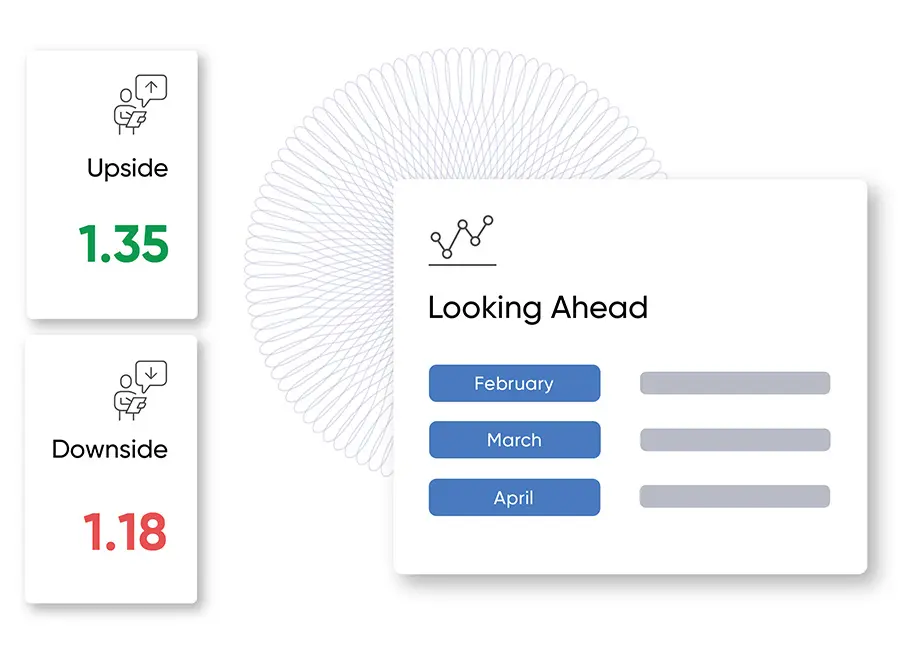

GBPEUR

GBP/EUR continued to ‘play ball’ with our long-standing downtrend market condition last week, continuing its steady march lower. The OBR issued a sobering long-term assessment of UK public finances, followed by weaker GDP data, topped off with BoE Governor Bailey’s comments in The Times around the need for larger rate cuts if the UK jobs market shows signs of a pronounced slowdown.

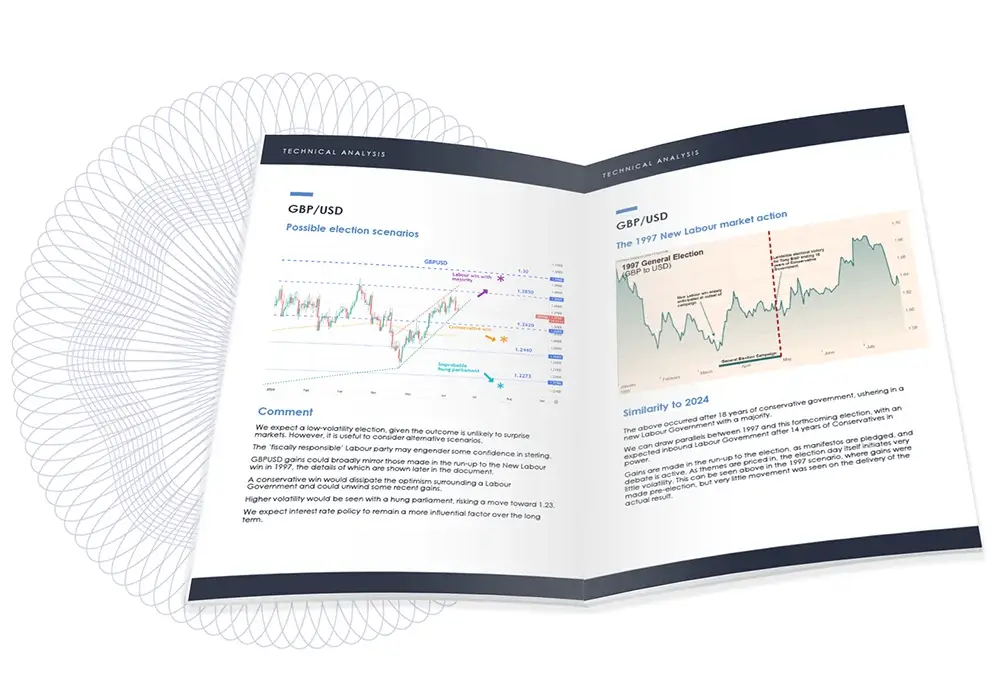

GBPUSD

GBP/USD continued to retrace within the wider uptrend last week. The expected minor dollar bounce helped suppress the upside, but it was some concerning projections about the future of the UK’s public finances, along with weak GDP figures, that kept sterling slightly under pressure after a period of strong gains. Bailey’s speech at Mansion House on Tuesday, followed by UK inflation data on Wednesday morning, are the key items to watch this week, alongside a busy slate of US data, including inflation and retail sales.

EURUSD

The euro traded water against a nascent short-term dollar recovery last week. The EU has postponed retaliatory tariffs while it seeks tariff relief on various sectors such as aerospace, autos, and others. Meanwhile, the US has formally announced ‘blanket tariffs’ of 30% on most imports from the EU and suggested that the 1 August deadline will not be extended. US data is the short-term driver of sentiment this week, with CPI (inflation) out tomorrow – the headline figure is expected at 2.6%, and a number above 2.8% would likely spur a further

dollar bounce.