Are you in the process of buying or selling a property abroad? Or are you making or selling a foreign investment or repatriating overseas income? If so, you are at risk of making a potential loss due to fluctuating exchange rates. To better manage this risk, ensure that your international transactions are delivered in a way that leverages the market to your benefit.

In this article, Argentex’s Head of Private Dealing, Joshua Haden-Jones, offers an overview of foreign exchange markets, how they affect your international transactions and weighs the benefits and risks of specific currency risk management products.

Understanding the foreign exchange market

FX markets determine the exchange rate for currencies around the world. Markets operate 24 hours a day, five days a week, from New York to Tokyo. Whilst major currency pairs such as GBPEUR or GBPUSD are more stable than emerging market currency pairs, you can expect frequent market fluctuations when making cross-border transactions. The value of a country’s currency can be impacted by myriad factors, from monetary policy changes to unanticipated events such as a pandemic. It is important to consider these factors when defining your approach to international transactions.

The foreign exchange market is a global marketplace that determines the exchange rate for currencies around the world.

Key factors that influence exchange rates

Many drivers can influence currency exchange rates. Some of the most prominent factors include:

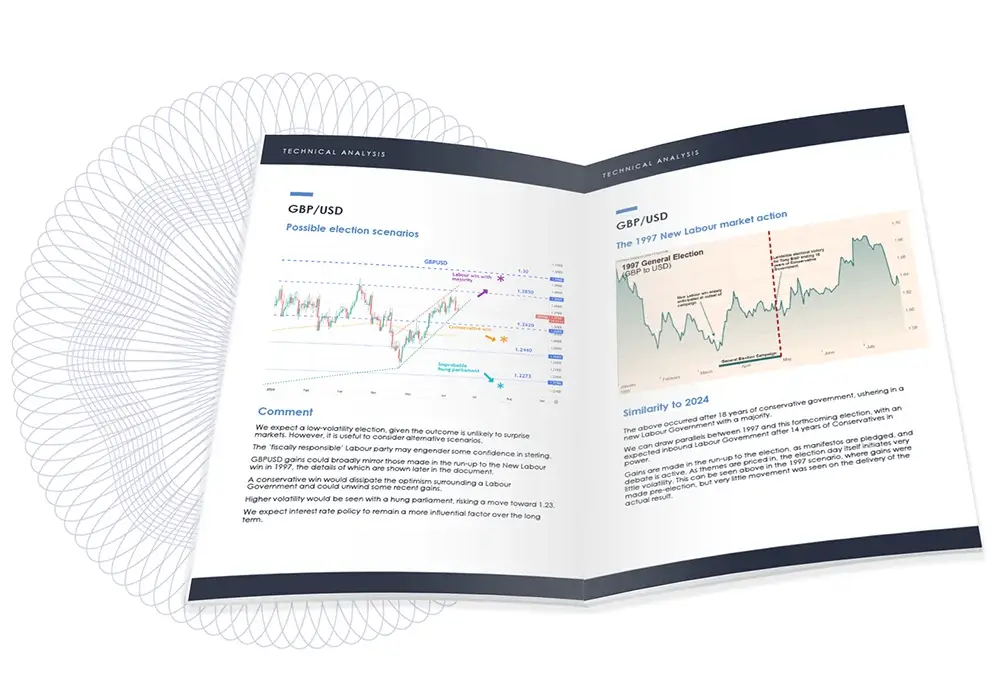

- Interest rates: Higher interest rates tend to attract foreign investment, increasing the demand for and value of a country’s currency. However, lower interest rates tend to deter foreign investment and will decrease a currency’s value.

- Political stability: Politics is one of the most important factors affecting exchange rates. Political factors such as parties’ economic positions, elections, social unrest and geopolitical tensions can cause significant volatility in FX markets.

- Economic performance and gross domestic product: A higher-than-expected GDP report can cause a currency to strengthen whereas a lower than anticipated GDP report can weaken a currency. Other indicators of economic performance include inflation, interest rates, unemployment and PMI data.

Managing the cost of international transactions

Buying currency on the spot market means the exchange is made up to two days after the trade is booked. Receiving expert guidance on how to best manage your international transactions is important to ensure you receive a competitive rate from the live market.

Common obstacles when making global transactions include:

- Buying or selling property abroad: Investing in property is always a stressful process and is made significantly more complex when investing overseas. Taking a strategic approach to currency risk management can have a vast impact on sustaining the purchase or sale price.

- The sale or purchase of foreign investments, such as stocks granted by employers, can lose value if not managed effectively.

- Overseas income repatriation: Working across borders means you have the additional consideration of being paid in a foreign currency, which can have a substantial impact on your earnings.

Argentex’s private client team has extensive knowledge of currency markets and can help you manage the implications of fluctuations on your cross-border transactions.

Foreign exchange products: knowing the benefits and risks

At Argentex, we combine competitive exchange rates with increased transactional efficiency and astute market knowledge to give our clients an advantage when exchanging currency.

When deciding which products to choose, you should evaluate the benefits and risks of each.

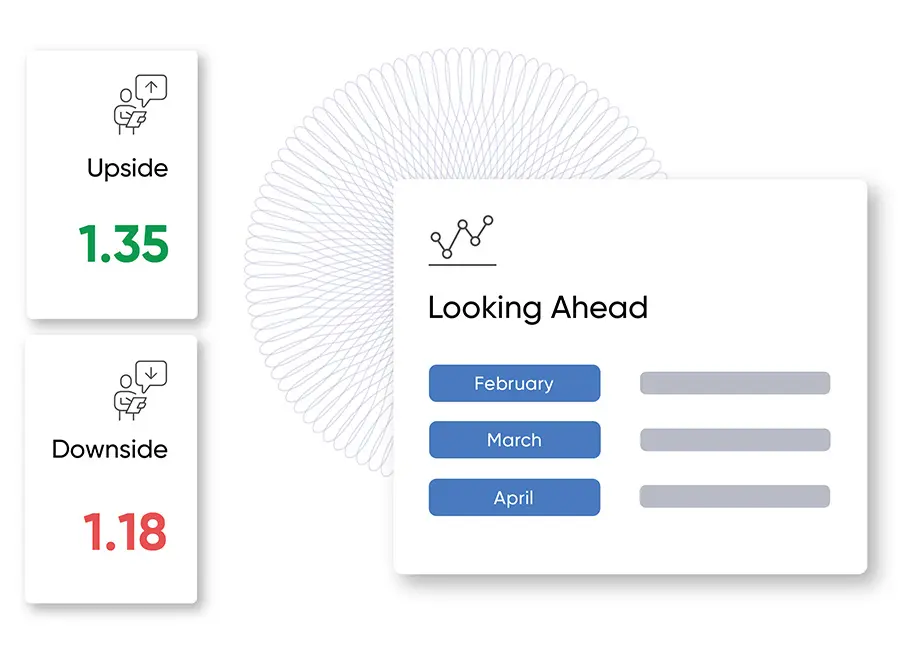

- Spot trades: Achieve competitive rates for immediate transactions, paid for up to two days in advance. Spot trades are the most flexible but can leave you exposed if rates begin to move against you.

- Forward contracts: Lock in a rate today to settle on a specific date up to two years ahead. Forward contracts are the best way to guard against foreign exchange risk over time and are useful when you don’t have the funds available immediately, but don’t want to be at the mercy of the rates whilst you wait. We require a 10% deposit to be held against the trade until its conclusion. This deposit can then be used against the trade upon settlement. By entering into a forward contract, the agreed set rate will not change regardless of the spot rate when the contract becomes due.

- Market orders: Enhance your approach to currency risk management by using market orders to buy and sell currencies when the market hits your desired rate. Market orders can be an effective way of getting rates that are not yet available from the market, but if the rate is never achieved, you can risk more losses by holding on.

We can provide strategies that include some or all of the above products based on your risk appetite, reason to trade and how much time you have to make your transfer.

As global payment and currency risk management specialists, we offer bespoke services alongside market leading technology for private clients. We use our vast market knowledge to provide you with advice and guidance tailored to your specific requirements. Our exchange rates are more competitive than most banks and our efficient service means your transaction is completed quickly and hassle-free.

For more information on Argentex’s global payments and currency risk management solutions, email me at [email protected] or call me on +44 (0)20 3772 0322.

*For clients’ understanding and awareness, Argentex is a debt-free, cash-rich business and operates as a Riskless Principal broker for non-speculative commercial currency transactions. Each client trade is matched at one of the firm’s institutional counterparties. Argentex does not charge transfer fees and solely profits off the price differential between what the business is charged by our banking counterparty and the rate offered to clients.