With holiday packages at peak demand, travel businesses are faced with fluctuating currency markets and payment terms that leave them vulnerable to losses. Read how Argentex has helped our travel industry clients overcome the uncertainty of currency volatility with forward contracts.

Problem: Payment terms that leave businesses vulnerable to financial losses

One of the main challenges affecting the profit margins of holiday package providers is fluctuating currencies from the time of booking to the time of receiving final payment for a given holiday. Argentex has worked with various clients across the travel industry, helping them navigate the complexities of staggered payments and reduce the impact of FX movements on their profit margins.

For example, if a UK holiday package provider has booked a US holiday for £1,000 on 1 January, charging the consumer a marked-up price of £1,600 for a vacation on 24 July, the final payment from the client isn’t required until 17 July, leaving the £600 profit at risk.

The adverse impact of market movements means the travel package provider may need to take a hit on its margins, potentially affecting business operations and package pricing.

Solution: Effectively managing payment terms with a fixed rate and credit line

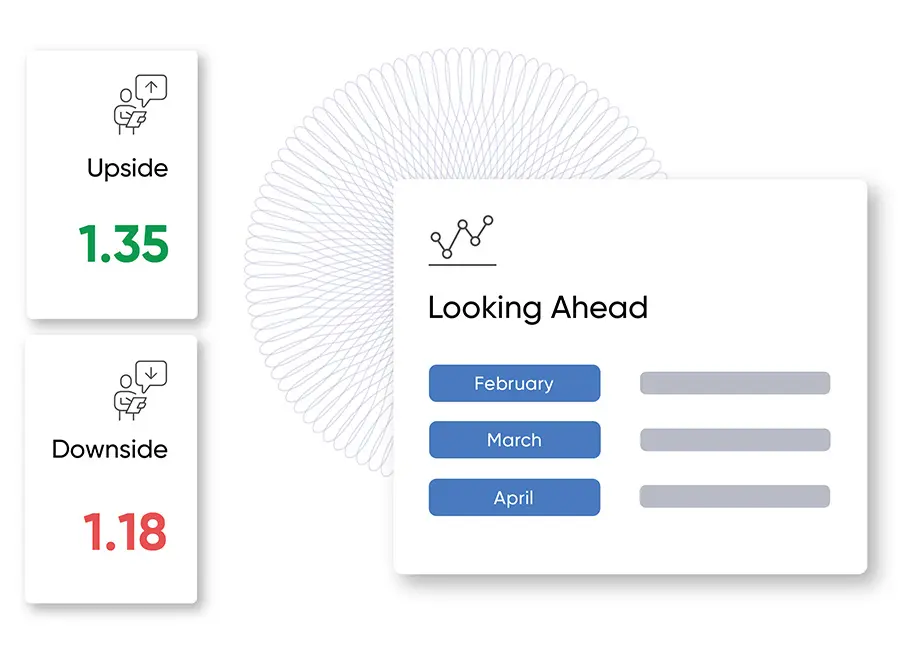

Argentex offers bespoke solutions to clients in the travel industry, taking the time to understand each client’s unique circumstances and working collaboratively to find the optimal solution. In this instance, we would recommend the certainty of a forward contract, suggesting the travel business confirms this on the day its client books on 1 January thereby securing a set rate. When the travel package provider’s client makes full payment on 17 July, the provider would maintain its profit margin as its rate would be fixed for this timeframe.

As an additional solution, Argentex would couple the forward contract with a credit line including a 5% initial deposit, allowing the travel package provider to pay only 5% of the holiday cost upfront and a further 95% on 17 July. The contract would be booked for value date 17 July, enabling the agency to access the agreed rate before that date and settle the contract should the client make payment earlier.

Result: Flexibility and certainty

Combining a forward contract with a credit line will significantly reduce the impact of adverse market moves and allow the travel business to maintain its profit margins, competitively cost its packages, invest in growth and better anticipate revenue.

For more information about Argentex’s payments and currency risk management solutions, please contact us on [email protected].

Disclaimer: Argentex LLP is authorised and regulated by the FCA for the provision of the investment services, FRN 781007, and for the issuing of electronic money, FRN 900671. This document specifically refers to those services offered by Argentex that do not fall within the scope of investment services – spot contracts and forward contracts that meet the mean payment exclusion criteria as defined in the MiFID II regulations. Nothing contained in this document should be construed as advice, a personal recommendation or inducement to deal in any MiFID II designated financial instruments. www.argentex.com