Background

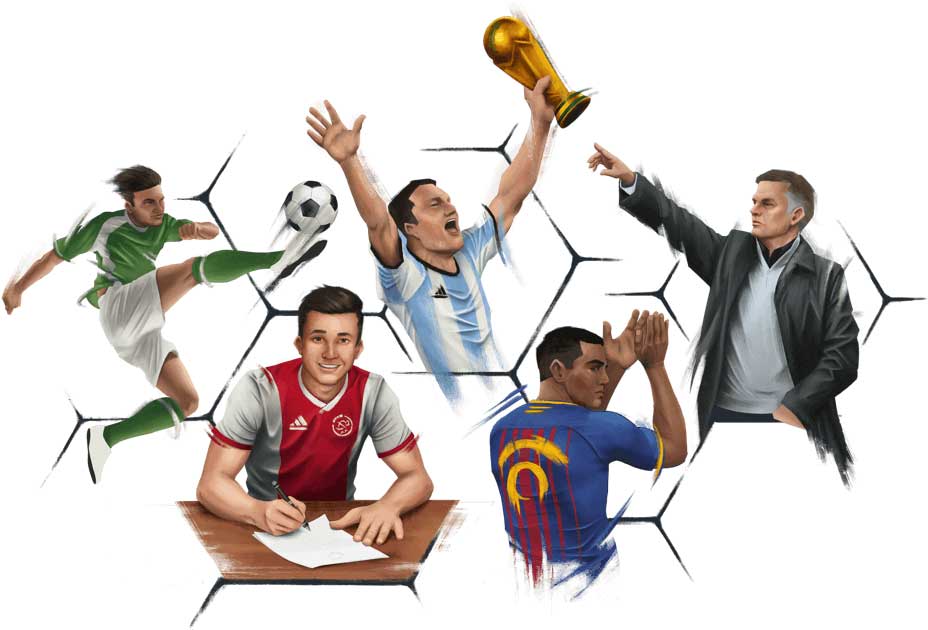

Our client, a fresh produce importer based in the UK, conducts business transactions in US Dollars by purchasing products from Africa. As a major supplier to prominent supermarkets like M&S, Tesco, and Sainsbury’s, they play a crucial role in the global supply chain. Our client’s sales team actively pitches their high-quality produce to these supermarket giants.

A critical aspect of this process is transparency around exchange rates. While a supermarket pays our client in British Pounds (sterling), our client quotes prices to them in US Dollars. Achieving a favourable exchange rate is integral to their competitive selling process.

Challenge

The supermarkets’ purchase orders for specific produce, such as vegetables, are sporadic and depend on their underlying sales volumes.

Our client needed an FX solution that mirrored the flexibility demanded by the supermarkets. Their legacy banking provider fell short of providing the desired flexibility. As a result, currency volatility occasionally eroded profit margins.

Solution

Working closely with our client, we devised a strategy to address their specific needs. Here’s how we helped:

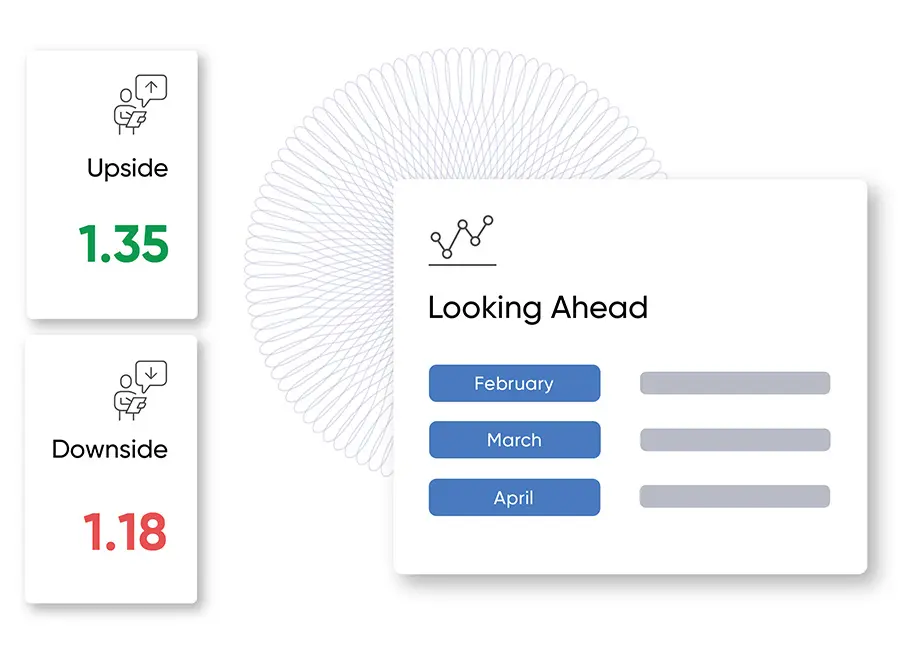

- Flexible Forward Contract: We recommended a 12-month flexible forward contract. This contract allowed our client to fix the exchange rate for a substantial amount—$30 million—while maintaining the flexibility to utilise it incrementally throughout the contract’s duration. Whether the supermarket required the produce immediately or at a later date, our client remained shielded from currency fluctuations.

- Risk Mitigation: By locking in the exchange rate, our client gained peace of mind. They could confidently plan their financials, even without precise knowledge of when the supermarket would trigger its purchase orders.

- Sales Strategy Alignment: Our assistance extended beyond the financial aspect. We helped our client align their sales strategy by providing accurate exchange rate information during negotiations with the supermarkets. This transparency strengthened their position and contributed to winning the contract.

Outcome

The results were significant:

- Contract Win: Our client secured the contract with one of the major supermarkets, thanks in part to our strategic guidance on exchange rates.

- Enhanced Flexibility: Unlike traditional banking solutions, our client enjoyed greater flexibility and responsiveness, allowing them to adapt swiftly to their client’s demands.

- Improved Pricing: Our solution offered better pricing than their existing bank, contributing to healthier profit margins.

- Competitive Edge: In a fiercely competitive industry, our client’s ability to protect profit margins became a crucial differentiator.

In summary, our tailored FX strategy empowered our client to navigate currency challenges effectively, ensuring sustainable growth and success in the fresh produce market.

For more information about Argentex’s payments and currency risk management solutions, please contact us on [email protected].

Disclaimer: Argentex LLP is authorised and regulated by the FCA for the provision of the investment services, FRN 781007, and for the issuing of electronic money, FRN 900671. This document specifically refers to those services offered by Argentex that do not fall within the scope of investment services – spot contracts and forward contracts that meet the mean payment exclusion criteria as defined in the MiFID II regulations. Nothing contained in this document should be construed as advice, a personal recommendation or inducement to deal in any MiFID II designated financial instruments. www.argentex.com