Subsidiaries often struggle to enter new markets, where opening bank accounts can be a lengthy and complex process. Learn how Argentex helped a new UK subsidiary grow its business with our multi-currency account, offering quick onboarding and the ability to effectively manage all global funds through a single platform.

Background: Navigating onboarding complexities as a newly incorporated UK business

Our client, a successful logistics company based in Dordrecht, the Netherlands, was struggling to open a UK bank account as a newly incorporated business. Lengthy processing times and cross-jurisdictional compliance checks meant that the company was unable to make or receive payments in GBP.

Solution: Send, receive and hold payments in up to 15 currencies with one vIBAN

Our team of experts worked with the client to establish a solution that would meet its unique requirements. As a pre-existing customer, the finance team required its predetermined employees in the Netherlands to make and receive payments into its own named UK account. As Argentex already held substantial documentation of the company, the client was able to successfully onboard for a multi-currency account within five working days.

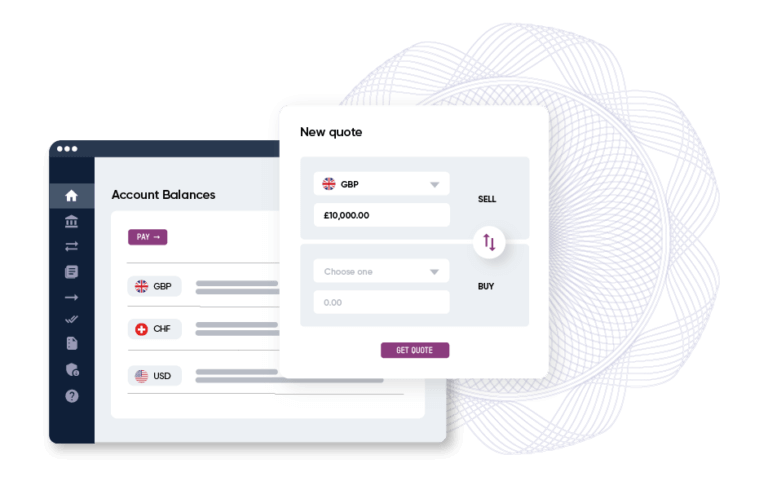

Offering the ability to send, receive and hold payments in up to 15 currencies, the multi-currency account enabled the client to instantly carry out transactions with a secure payment and approval structure and full reporting capabilities.

Result: Freeing up time to focus on growth

Argentex has helped the client fulfil its international growth objectives by providing payment convenience and efficient foreign exchange risk management. Working with the team at Argentex, the firm was able to streamline its international business by using a treasury system to manage its global funds through a single platform.

For more information about Argentex’s payments and currency risk management solutions, please contact us on [email protected].

Disclaimer: Argentex LLP is authorised and regulated by the FCA for the provision of the investment services, FRN 781007, and for the issuing of electronic money, FRN 900671. This document specifically refers to those services offered by Argentex that do not fall within the scope of investment services – spot contracts and forward contracts that meet the mean payment exclusion criteria as defined in the MiFID II regulations. Nothing contained in this document should be construed as advice, a personal recommendation or inducement to deal in any MiFID II designated financial instruments. www.argentex.com