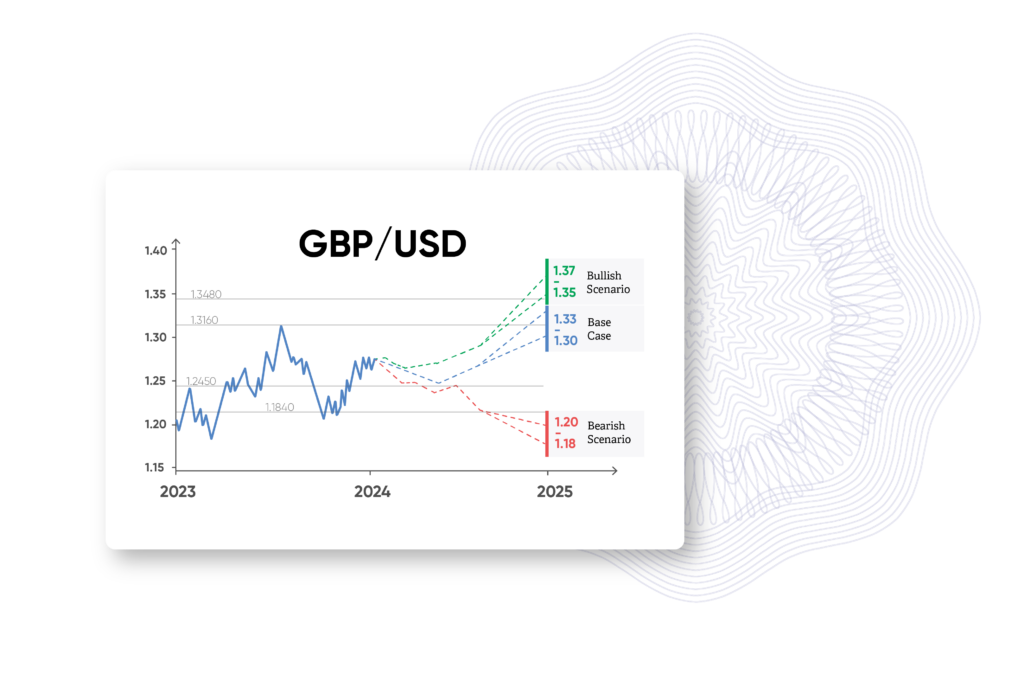

Argentex’s Managing Director, Daniel Ross, discusses why FX scenario modelling is an important tool for businesses managing international costs, the benefits of outsourcing expertise and leveraging currency risk management to achieve financial targets.

FX scenario modelling is a complex process but well worth the effort if your business has significant currency exposure. Used as a tool for cash forecasting, scenario modelling enables businesses to identify and manage currency risks by anticipating multiple potential future outcomes based on bullish, base and bearish scenarios. These scenarios can help businesses develop suitable hedging strategies and protect their bottom line.

Informing the year ahead

FX scenario modelling should be seen as insurance that any business managing international costs and budget needs to consider. Currency fluctuations will regularly impact businesses’ profit margins throughout the year, which are often set in budgets annually based on assumed exchange rates. Leveraging this technique, a CFO can create different base cases and predict the impact of specific rate changes on the business’ costs and revenues.

Scenario analysis involves assessing the potential impact of specific events or scenarios on exchange rates. Businesses can assess possible outcomes and related risks by modelling various scenarios.

Leveraging expertise

Many businesses do not have the resources or experience to carry out such specialised analysis. A small business may only have one employee managing its finances. Lacking time and bandwidth, forecasting currency rate movements tends to fall outside the remit of the finance team. Importantly, FX scenario modelling requires expertise in currency movements and risk, which are uncommon in smaller finance teams. In these instances, firms should explore outsourcing their FX risk management to a dedicated team acting as an extended support function that will undertake FX scenario modelling on their behalf.

Hedging against risks to achieve profit margins

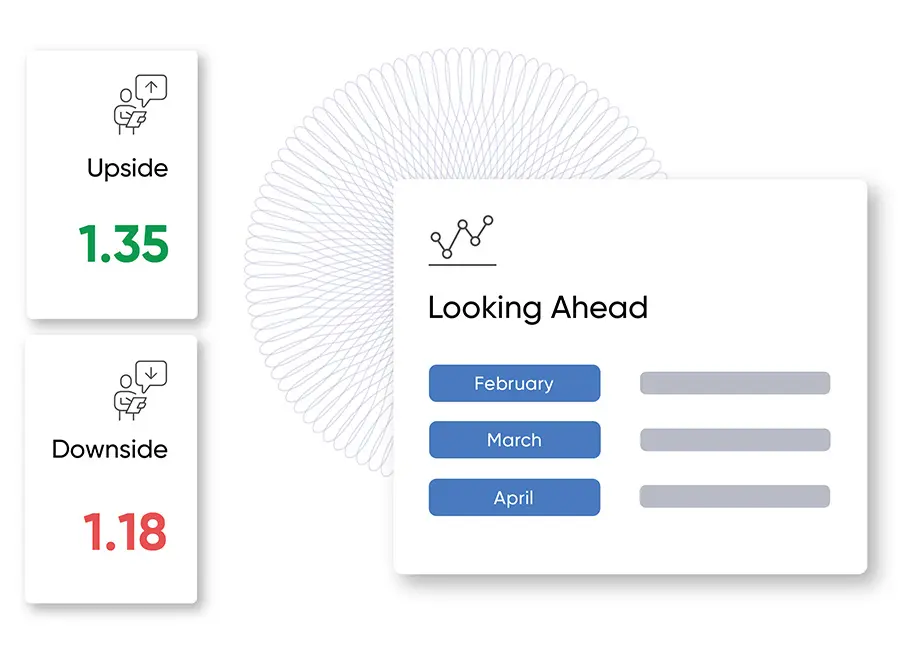

Most businesses seek to maximise profits by maintaining high margins. FX scenario modelling supports this objective and helps businesses achieve their intended financial goals. Modelling different scenarios will predict how changing currency rates affect profit margins and how different hedging strategies will buffer the impact of these fluctuations. Consequently, it allows CFOs and Treasurers to take appropriate measures to hedge against possible risks, achieve desired profit margins and potential opportunity gains.

Aligning with risk appetite and FX objectives

There is no one-size-fits-all approach to scenario modelling for businesses. FX scenarios will depend on a firm’s risk appetite and objectives. Some may only want to manage risks to their profit margins, whilst others may actively seek to capitalise on FX gains. Modelling specific currency scenarios can help forecast on different scales and offer top and baseline options.

Outsourcing with confidence

As global payment and currency risk management specialists, Argentex will undertake the FX scenario modelling on a firm’s behalf and offer full transparency in our guidance. FX scenario modelling is inherently difficult and through speaking to risk management experts, firms can identify the potential impact of rate changes on costs and revenues, hedge against different outcomes and achieve financial targets.

To find out how our team of FX experts can support your business’ currency risk management requirements, please contact us via [email protected].