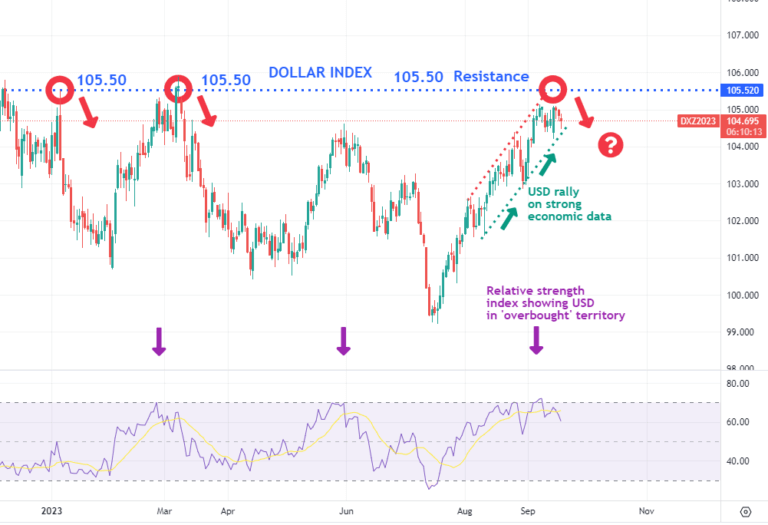

After nine consecutive weeks of US dollar gains, the Dollar Index (DXY) is probing a key chart resistance level, and the rate of the rally has taken the currency into ‘overbought territory’. After a strong run of excellent US data, we ask the question, is the dollar priced to perfection and vulnerable to a correction?

- Dollar Index is the USD versus a basket of other currencies (57% Euro, JPY 13%, GBP 11% etc).

- The above year to date chart illustrates that the DOLLAR INDEX has almost reached a chart resistance level of 105.50. We can see above that this was a major level in Q1 2023. The expectation is that the Dollar will pause / retrace from here.

- Further, the relative strength index shown in the lower segment of the chart illustrates the ‘overbought’ nature of the current rally. RSI levels above 70 are ‘overbought’. Last week the dollar index reached 73.

- The two prior occurrences of the RSI reaching overbought territory are marked by the purple arrows. We can see that after such peaks, the following two months saw a period of USD weakness.

Receive weekly currency market insights delivered to your inbox every Monday by registering for the FX Majors.