Published date: 30 June 2025

GBPEUR

GBP/EUR remained within the downtrend channel last week, bouncing from trendline support and failing at trendline resistance. The sterling bounce was assisted by the sharp sell-off in oil but was quickly challenged by some dovish BoE rhetoric and a residually resilient euro. There is little market-moving scheduled data for these two currencies this week, barring eurozone inflation on Tuesday, leaving wider market forces at play and a chance for some further rangebound market action.

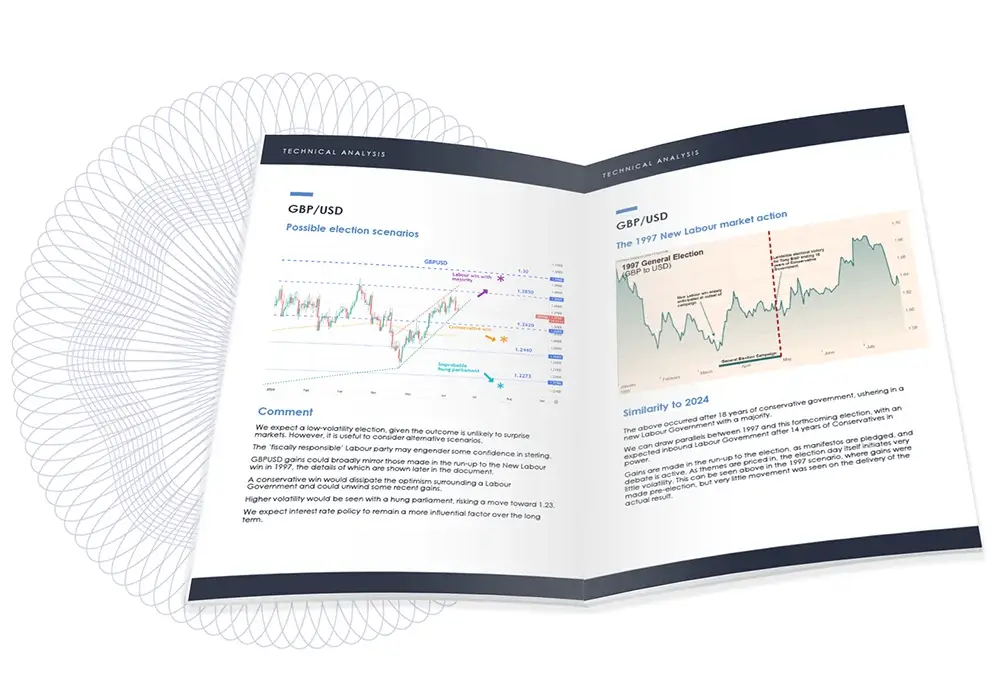

GBPUSD

The ceasefire quickly diffused market anxiety last Monday, expediting further dollar weakness once again. This was followed later in the week by another attack on Fed Chair Powell by President Trump. GBP/USD continues to trend relentlessly higher, but this is primarily a function of dollar weakness. Some challenges to sterling strength may be imminent, driven by a softening UK labour market and a more dovish shift from the BoE. Thursday’s Non-Farm Payrolls is the key event this week, with markets still unsure whether the Fed will cut in July.

EURUSD

This time last week, the escalating Middle East situation set the stage for a squeeze higher in the dollar. Such is the nature of the Trump presidency, by the end of Monday, oil was aggressively down, equities were back on the march, and the weaker-dollar ‘status quo’ had resumed. EUR/USD has forged a fresh momentum high in the uptrend we identified as beginning back in March. US Non-Farm Payroll data is the key release this week, arriving a day early to accommodate a US holiday on Friday.