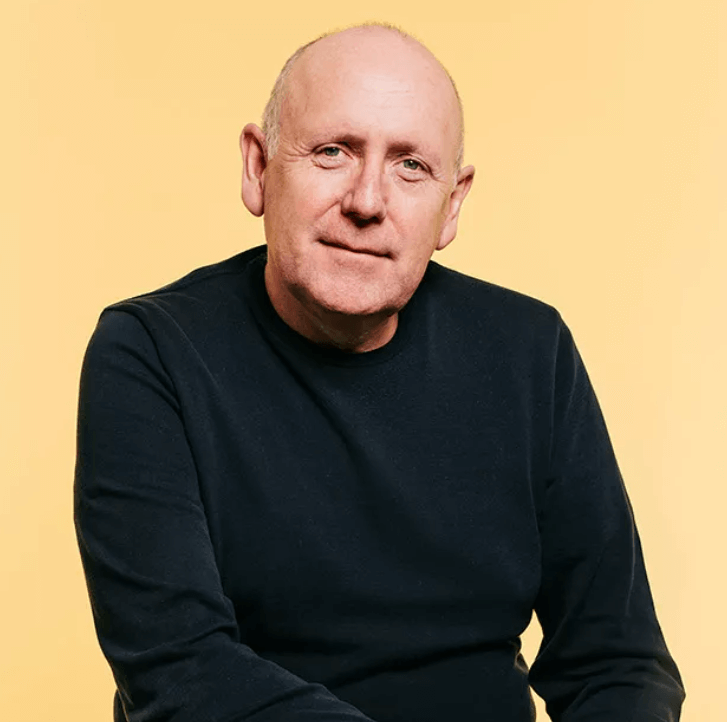

From start-up to international data-driven photo technology leader, Popsa’s Chairman Declan Mellett joins Argentex’s Alexa Rowlands to discuss how a robust foreign exchange hedging strategy helped the business achieve its international growth targets.

In our podcast, Declan recalls the knock-on effect of Brexit, topping Deloitte Technology Fast 50 charts three times and how rising revenues in foreign markets led him to investigate currency risk management solutions.

Meet Popsa

Since its launch in 2016, international technology and media company Popsa has expanded to over 50 countries, with multiple currency markets that require seamless global transactions.

As a classic start-up, UK-based Popsa began with little more than the founding members, meeting weekly at a coffee shop in Soho, London. Following backing from investors, revenues for the data-driven business skyrocketed.

Background: Rising international revenues

The company’s initial key markets were France, UK, Denmark, Switzerland and Norway, with internationalisation at the core of its strategy. Whilst the company’s business costs were in GBP, the UK only accounted for 17% of revenues. Initially, the business’ currency exposure was limited, however as international revenues grew, so did the potential for risk.

Challenge: Anticipating the unexpected

When revenues quickly started to surpass £8m the accounts team began discussing unrealised losses and unrealised gains, all of which are by-products of foreign exchange. In 2018, the business started trading its euros on spot and made gains. In that year, Popsa made gains on FX, which greatly contributed to the P&L. But what would happen if the market were to move against the business?

Solution: Taking a strategic approach to risk management

With the 2019 elections on the horizon as well as the impending deadline for Brexit, the business wanted to ensure it had a robust strategy in place to manage the impact of geopolitical events on currency markets. The Popsa team approached Argentex to help identify how best to manage its currency exposure as a scaling business. Together with their dedicated Argentex dealer, Popsa decided to hedge 50% of its exposure going forward 12-15 months. Desiring a prudent degree of flexibility, this solution provided the team with the confidence to forecast with accuracy whilst allowing hedging if required. Popsa’s strategic approach to currency risk management has enabled the company to effectively navigate market uncertainty to unlock its international growth potential.

For more information about Argentex’s payments and currency risk management solutions, please contact us on [email protected].

Disclaimer: Argentex LLP is authorised and regulated by the FCA for the provision of the investment services, FRN 781007, and for the issuing of electronic money, FRN 900671. This document specifically refers to those services offered by Argentex that do not fall within the scope of investment services – spot contracts and forward contracts that meet the mean payment exclusion criteria as defined in the MiFID II regulations. Nothing contained in this document should be construed as advice, a personal recommendation or inducement to deal in any MiFID II designated financial instruments. www.argentex.com